By plotting the successive day growth rates as X and Y values on a two dimensional scatter plot and drawing an L-shaped hyperplane at exactly 1.0 on both the X and Y axis’, we can visualise and conclude the results. When all values are grouped and analysed together, we have a sample representing the general economy. To categorically determine if a stock or cryptocurrency has successive positive or negative growth, we can use the Support Vector Machine algorithm’s “decision boundary” (hyperplane). With the usage of Z-scores, regardless of growth trend (positive or negative) it will then be possible to take advantage of the K-Means machine learning algorithm to cluster individual stock items into recommended investment categories.

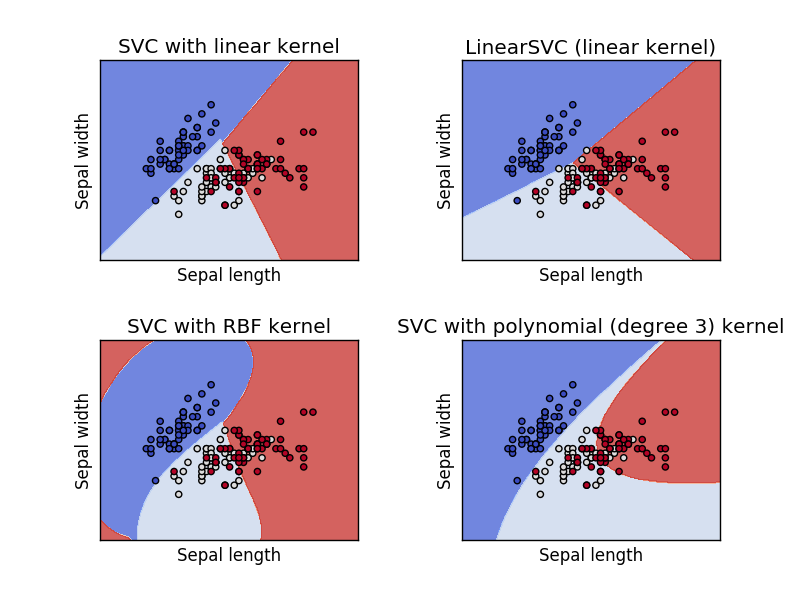

The Support Vector Machine algorithm can be used to determine the number of stock items in each sector and across all sectors as a whole to determine each growth trend and the overall growth trend of the general economy.įinally, by concatenating each of the time-series growth data files into a single consolidated array, we can calculate individual normalised Z scores for each stock item. The 4 sector-based individual samples have been created using Python web-scraping programming from the and websites. Each file has 3 columns (timestamp, stock item, stock price) īy calculating the time-series growth ratio, we have an ideal dataset to use with the support vector machine clustering algorithm to visualize the general strength of the economy and each sector. In an ideal scenario the total number of stocks with positive growth will outnumber the stocks with negative growth, otherwise, we can suggest the general economy or an individual sector does not have a strong health. The following four files have been created by calculating the daily growth rate from the 4 sector sets of 3 daily individual stock prices. As the growth rate is calculated as a ratio of difference from the current day divided by the previous day, the following files have 2 separate growth ratio values, which will then be fed into a two dimensional scatter plot. In order to perform analysis of the economy, different sectors and individual stock items, 3 consecutive daily price values of the top 10 stocks from 4 different sectors have been captured in time-series fashion. By comparing the price from one day to the other, it is possible to obtain a positive or negative growth ratio for each stock item. The recommendations will be diverse in sector and will recommend which stocks to invest in and which stocks to avoid. Solution: By capturing time-series data of various stocks from a diverse set of sectors, it is possible to determine the growth ratio of each sector as well as the general economy using Support Vector Machine algorithm. Furthermore, by clustering the data captured from each sector using K-Means algorithm, we can create recommendations of stock items based on their individual positive or negative growth rate. Problem Statement: In his article “Finding the right stocks and sectors” by Cory Mitchell, Dec 29 2017, Cory states that “top-down investment strategy is based on determining the health of the economy, the strength of different sectors and the strongest stocks within those sectors”. The average Australian investor today is faced with issues such as the banking royal commission, unpredictable mining sector stocks and an even more unpredictable cryptocurrency market. So how can we apply data science to determine economy health, sector strength and the strongest sector stocks?

0 kommentar(er)

0 kommentar(er)